Most small employers in San Antonio don’t get HR wrong because they’re careless. They get it wrong because they’re running on outdated, duct-taped systems. Employee files still sitting in milk crates. Policies passed down verbally from manager to manager. Onboarding that amounts to “shadow someone until you figure it out.”

The problem? These broken systems may feel cheap and fast, but they create massive hidden costs—turnover, inefficiency, and compliance risks that small businesses can’t afford.

At Faulkner HR Solutions, I’ve seen it across industries—healthcare, schools, oil and gas, startups, and even city governments. The pattern is always the same: leaders don’t realize how exposed they are until an audit, complaint, or lawsuit forces them to look.

Why listen to me?

With a doctorate in business, dual master’s degrees in leadership and management, and professional certifications including SPHR and Lean Six Sigma Black Belt, I bring both academic depth and practical expertise. Over the years, I’ve helped San Antonio employers in construction, healthcare, education, oil and gas, and local government strengthen their HR systems. What I’ve seen is consistent: when compliance is treated as an afterthought, it costs more in penalties, turnover, and inefficiency than it ever would to get it right the first time.

The real cost? One client avoided $47,000 in penalties simply by fixing worker classification. Another cut turnover from 65% to 23% after implementing clear policies and training.

The good news? Every one of these mistakes can be fixed—with practical, modern solutions that actually work in San Antonio small businesses.

Why HR Compliance in San Antonio Small Businesses Gets Overlooked

Quick Take: Compliance failures usually come from outdated processes, not bad intent. The “we’ve always done it this way” mindset is the #1 reason San Antonio small businesses get caught off guard.

San Antonio employers are resourceful. You stretch budgets, wear multiple hats, and make things happen with limited staff. But when it comes to HR compliance, “making do” is what puts you at risk.

Common Compliance Challenges for San Antonio Employers

From my work across the region, here are the patterns I see most:

- Unwritten policies that shift depending on who you ask.

- Old job descriptions that haven’t been updated in over a decade.

- Paper records that collapse the moment an auditor walks in.

Each of these creates cracks in your foundation—cracks that grow bigger the longer they’re ignored.

Real Example: A 40-employee construction company I worked with had three different managers giving three different answers about overtime policies. When the Department of Labor investigated a complaint, they owed $23,000 in back wages because their "policy" was whatever each supervisor remembered from training five years ago.

Do This Now: Audit one HR process this week—payroll, training, or leave. Ask two supervisors the same policy question. If you get different answers, you have a compliance problem.

Don't assume "no complaints" means you're safe. It usually means problems are hidden.

The Most Overlooked HR Compliance Mistakes San Antonio Small Businesses Make

Quick Take: The biggest mistakes aren’t flashy—they’re small gaps in policies, training, and systems that add up over time.

1. Failing to Document Employee Policies in San Antonio Workplaces

Too many San Antonio businesses run on "policies" that live only in someone's head. One manager says vacation requests need two weeks' notice, another says one week is fine. Employees get frustrated. Leaders lose credibility. HR spends weeks cleaning up the fallout.

The Real Cost: Employment attorneys charge $350-500/hour to clean up policy disputes. A simple handbook written by a trusted HR consultant prevents most of these issues.

Fix - The Complete Approach:

Step 1: Create Your Texas-Specific Employee Handbook Your handbook must include these Texas-specific elements:

- At-will employment disclaimer (required language available from Texas Workforce Commission)

- Payday law requirements (employees must be paid at least twice monthly)

- Final paycheck timing (within 6 days of termination)

- Jury duty and voting leave policies

- Workers' compensation information

Step 2: Essential Policy Sections Every San Antonio Business Needs

- Anti-harassment and discrimination policy with clear reporting procedures

- Social media and technology use policy

- Leave policies (FMLA, state leave, company policies)

- Discipline and termination procedures

- Safety and security protocols

Step 3: Implementation Timeline

- Week 1: Draft core policies using templates

- Week 2: Legal review (budget $1,500-3,000 for attorney review)

- Week 3: Manager training on new policies

- Week 4: Employee rollout with signed acknowledgment forms

Sample Policy Language for Common Situations:

Vacation Request Policy: "All vacation requests must be submitted at least [X] business days in advance through [system/person]. Requests will be approved based on business needs and seniority, with a maximum of [X] employees from each department allowed off simultaneously."

2. Employee Misclassification in San Antonio Small Businesses

The Texas Workforce Commission doesn't care if you "thought" someone was a contractor. I've seen fast-scaling businesses rack up penalties and back pay because they treated workers as 1099s to save on payroll.

The Real Cost: Misclassification penalties average $1,000-5,000 per worker, plus back taxes, overtime, and benefits. One San Antonio tech startup paid $78,000 for misclassifying just 6 developers.

Fix - The Annual Classification Audit:

The 3-Factor Test Every San Antonio Employer Should Know:

- Behavioral Control: Do you control how, when, and where the work is done?

- Financial Control: Do you control the business aspects of the worker's job?

- Relationship Type: Is this an ongoing relationship with benefits?

Why it matters: Misclassifying employees as contractors is one of the most common—and costly—HR compliance mistakes in San Antonio. The Texas Workforce Commission and IRS both use this test when auditing businesses. Failing to classify correctly can lead to back pay, penalties, and legal disputes. Learn more in our 1099 vs W-2 Quick Reference Guide.

Red Flags That Scream "Employee" Not "Contractor":

- Works exclusively for your company

- Uses your equipment and workspace

- Follows your schedule and procedures

- Receives training from your company

- Work is integral to your business operations

Your Annual Classification Checklist:

- Review all 1099 workers using the 3-factor test

- Document the business justification for contractor classifications

- Ensure contractors have proper business licenses and insurance

- Review contracts to ensure they reflect true independent contractor relationships

- Budget for reclassification costs if needed

Case Study: At a 25-employee manufacturing company, three so-called “contractors” worked full schedules under company control. On paper, they looked like savings; in practice, they were a compliance liability. We corrected their classification, saving the company $15,000 in potential penalties and preventing future audit risk. Just as important, managers no longer had to second-guess who counted as staff, which streamlined payroll and reduced confusion across the team.

3. Skipping Mandatory HR Training in Texas Small Businesses

I hear this constantly: "We're too small for formal training." That's a myth. Whether it's harassment prevention, safety standards, or compliance refreshers, skipping training is the fastest way to create risk.

The Real Cost: The average harassment lawsuit settlement is $75,000. OSHA fines start at $15,000 per violation. Training costs $50-200 per employee annually.

In industries like healthcare and behavioral health, lack of training directly drives turnover and investigations.

Fix – Build a Lean Training System

Training doesn’t have to be expensive or complex to protect your business. A clear, consistent plan is what matters most.

Essential Training Every San Antonio Business Needs

New Employee Onboarding (First 30 Days)

- Company policies and procedures (2 hours)

- Anti-harassment and discrimination training (1 hour)

- Safety training specific to the role (varies)

- Job-specific skills training (varies)

👉 For a deeper dive into building onboarding that works, see our Texas HR Compliance Guide for Small Businesses (2026): The Owner’s Playbook.

Annual Refresher Training

- Policy updates (30 minutes)

- Safety refresher (1 hour)

- Industry-specific compliance (varies)

Manager-Specific Training

- Conducting interviews and avoiding discrimination (2 hours)

- Performance management and documentation (2 hours)

- Leave administration (1 hour)

- Progressive discipline procedures (1 hour)

Training Implementation That Actually Works

Week 1–2: Choose Your Delivery Method

- In-person for companies under 25 employees

- Online modules for larger or multi-location businesses

- Hybrid for mixed workforces

Week 3: Create Training Schedules

- Block time monthly for new hire training

- Schedule annual refreshers during slower periods

- Build manager training into leadership development

Week 4: Document Everything

- Training attendance records

- Test scores or completion certificates

- Follow-up assessments

Pro Tip: Many San Antonio businesses try to piece together training from multiple vendors—chamber workshops here, online modules there—only to discover gaps in coverage and inconsistent messaging. At Faulkner HR Solutions, we design comprehensive training programs specifically for San Antonio's unique business environment, covering everything from Texas-specific compliance to industry-focused safety protocols. While DIY approaches might seem cheaper upfront, a coordinated training strategy often costs less and delivers better results than managing multiple vendor relationships.

4. Poor HR Recordkeeping for San Antonio Employers

I've walked into businesses where personnel files lived in four different rooms, payroll data was scattered across spreadsheets, and I-9s were crammed in an unlocked drawer. That's not just sloppy—it's a compliance landmine.

The Real Cost: USCIS fines for I-9 violations range from $252-2,507 per form. Poor recordkeeping during audits can multiply penalties and extend investigations.

Fix - The Digital Transformation Roadmap:

Phase 1: Audit Your Current System (Week 1) Create an inventory:

- Where are personnel files currently stored?

- What documents are missing from employee files?

- How long does it take to locate a specific record?

- Who has access to confidential information?

Phase 2: Choose Your Digital System (Week 2)

For Companies Under 25 Employees:

- Cloud-based solutions like BambooHR, Gusto, or Paychex

- Cost: $3-8 per employee per month

- Features needed: document storage, e-signatures, basic reporting

For Companies 25-100 Employees:

- More robust systems like ADP, Paycom, or UltiPro

- Cost: $8-15 per employee per month

- Features needed: workflow automation, advanced reporting, integration capabilities

Essential Features Every System Must Have:

- Secure document storage with access controls

- Automated backup and disaster recovery

- Audit trail tracking who accessed what when

- E-signature capabilities for policy acknowledgments

- Mobile access for remote managers

Phase 3: Migration Strategy (Weeks 3-6)

Week 3: Set up new system and train administrators Week 4: Begin scanning and uploading current employee files Week 5: Train managers on new processes Week 6: Go live with new system, keeping paper files as backup initially

Phase 4: Maintenance and Optimization (Ongoing)

Monthly Tasks:

- Review access permissions

- Update employee information changes

- Backup verification

Quarterly Tasks:

- System security audit

- User training refresher

- Process improvement review

What Documents Must Be in Every Employee File:

- Employment application and resume

- Offer letter and employment agreement

- I-9 form (store separately from personnel file)

- Tax withholding forms (W-4, state forms)

- Emergency contact information

- Performance reviews and disciplinary actions

- Training records and certifications

- Leave requests and approvals

- Termination documentation (when applicable)

👉 Need a full checklist of what belongs in every employee file? See our Texas HR Compliance Guide for Small Businesses (2026): The Owner’s Playbook.

Case Study: A San Antonio healthcare practice with 35 employees was drowning in paper files—spending over 8 hours every month just on organization, and scrambling for 40+ hours whenever an audit loomed. After implementing a digital HR system, file management dropped to 1 hour monthly, and audit prep shrank to just 4 hours. That’s a 90% reduction in wasted time and a direct savings of more than $10,000 a year in administrative costs—all while giving managers instant, secure access to records when they needed them most.

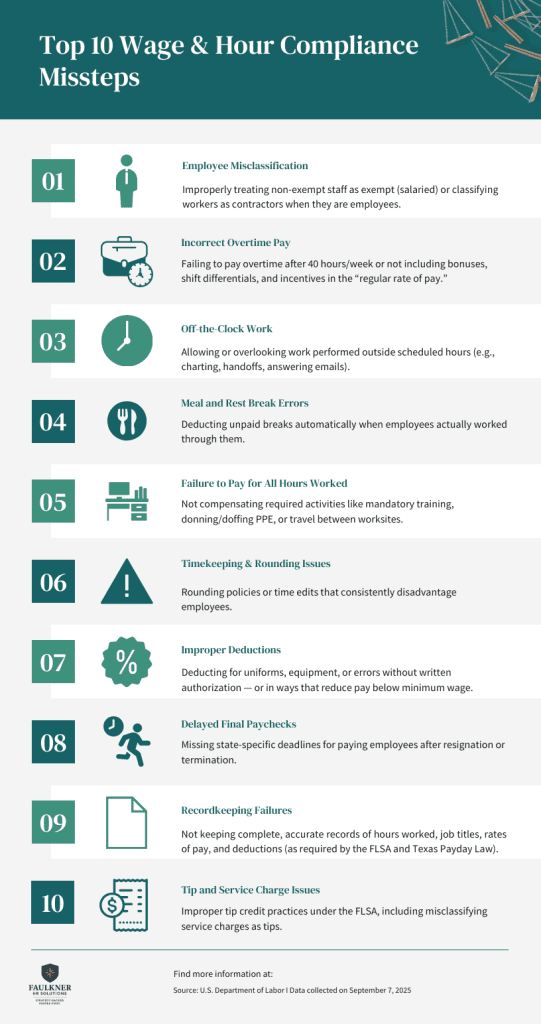

Wage and Hour Compliance Missteps for San Antonio Businesses

San Antonio’s service-heavy economy is a magnet for wage and hour mistakes — especially in hospitality, call centers, and healthcare.

Case Snapshot: A River Walk restaurant chain misused the tip credit. They told servers verbally but never provided written notice. When one server filed a complaint, the Department of Labor forced $80,000 in back pay across the chain. The fix? A single-page notice signed by each employee.

Why Employers Trip Up

- Believing Texas’ business-friendly climate means relaxed wage laws.

- Assuming travel time or remote work doesn’t count as paid time.

- Letting supervisors “look the other way” on off-the-clock work.

Decision Framework:

When in doubt, ask three questions:

- Did the employee work?

- Did the employer benefit?

- Was the employee free to decline?

If the answer is “yes, yes, no,” then it’s work time — and it must be paid.

Unstructured Leave Management

The Mistake: Employers often assume that because San Antonio has no local paid sick leave ordinance, they can improvise. But federal FMLA, ADA, and USERRA protections absolutely apply.

San Antonio Twist: With major military bases like Lackland and Fort Sam Houston, local employers encounter military leave requests more than most Texas cities. Many stumble on USERRA requirements — especially reemployment rights after military service.

Red Flag Signs Your Leave System Is Broken:

- Leave requests tracked in spreadsheets scattered across departments.

- “One-off” decisions without documentation.

- Supervisors denying leave without consulting HR.

Case Example: A call center denied intermittent leave for an employee with PTSD related to military service. The EEOC charge cost them far more than building a proper ADA process would have.

👉 Proactive leave management isn’t just compliance — it’s retention. San Antonio’s workforce is too tight to lose employees over mismanaged leave.

Advanced Compliance Strategies: Monthly and Annual Maintenance

Before you dive into the details, you can grab the full Advanced Compliance Strategies: Monthly and Annual Maintenance Checklist as a downloadable resource. It’s the same step-by-step system outlined below—packaged so you can keep it on hand for quick reference.

Your Monthly HR Compliance Checklist

First Monday of Every Month:

- Review new hire paperwork for completeness

- Update employee status changes in HRIS

- Check for overdue training requirements

- Review workers' compensation claims and safety incidents

- Audit overtime hours and approve exceptions

Payroll Periods:

- Verify proper wage calculations and deductions

- Review time-off accruals and usage

- Check contractor vs. employee classifications for new engagements

End of Month:

- Generate compliance dashboard report

- Review employee complaints or concerns

- Update policy acknowledgment tracking

Your Annual Compliance Deep Dive

January - Legal Updates:

- Review federal and state employment law changes

- Update employee handbook and policies

- Schedule legal compliance audit

March - Classification Review:

- Audit all contractor relationships

- Review job descriptions for accuracy

- Assess exempt vs. non-exempt classifications

June - Training Assessment:

- Evaluate training effectiveness

- Plan annual training schedule

- Update safety protocols

September - Records Audit:

- Review personnel file completeness

- Purge outdated documents per retention schedule

- Test backup and recovery systems

November - Benefits and Compensation:

- Conduct pay equity analysis

- Review benefit plan compliance

- Prepare for open enrollment

Red Flags That Signal Immediate Attention

Call Faulkner HR Solutions Immediately If You See These Red Flags

- Employee complaints about discrimination or harassment

- EEOC, DOL, or TWC investigation notices

- Workers' compensation claims with potential retaliation issues

- Mass resignations or unusual turnover patterns

- Managers making hiring/firing decisions without documented processes

Call an Attorney Immediately If You Receive:

- Lawsuit papers or legal demand letters

- Union organizing activity

- Wage and hour collective action notices

- OSHA citations with willful or repeat violations

How San Antonio Employers Can Stay HR Compliant Without Adding Red Tape

Quick Take: Compliance doesn’t mean bureaucracy. The best systems are lean, practical, and designed to work in small businesses.

Practical HR Compliance Solutions for San Antonio Small Businesses

Most leaders fail because they copy big-company HR models that don’t fit. The result? Too much paperwork, too little action. What works instead:

- Quarterly HR checkups instead of waiting for problems.

- Lean policies written in plain English that managers can explain in 30 seconds.

- Digital tools that automate recordkeeping instead of adding admin burden.

- Local HR partnerships with experts who know San Antonio’s workforce culture, not just the laws.

Lean HR Framework:

- Quarterly: Run a 1-page HR checkup using our HR Self-Audit Tool.

- Monthly: Update one policy or process for clarity.

- Annually: Meet with a local HR expert (we’ll connect you for a free call).

FAQs: San Antonio HR Compliance for Small Business Owners

Yes. Even with fewer than 15 employees, a handbook sets clear expectations and reduces compliance risk. Courts often view the absence of written policies as evidence of inconsistent or discriminatory practices. Ensure your handbook includes anti-harassment, at-will employment, and complaint reporting procedures to reduce legal exposure.

Texas employers must display federal labor law posters (EEO, FLSA, OSHA, FMLA if applicable) and state posters, including the Texas Payday Law and Workers’ Compensation notices. Posters must be in English and Spanish in a visible workplace location. Display the FMLA poster only if your business is covered under FMLA (typically 50 or more employees).

Final wages must be paid within six days of termination. Missing this deadline can result in Texas Workforce Commission complaints and penalties. For employees who resign, final wages are due on the next regular payday.

Employee misclassification. Many businesses wrongly treat employees as independent contractors to save on payroll costs. The Texas Workforce Commission frequently audits classification errors, which can result in back pay, penalties, and benefits liability. Use the IRS’s Common Law Test or the Department of Labor’s guidance to determine worker status.

No. Texas law does not mandate paid sick leave. However, San Antonio employers must comply with federal leave laws (like FMLA if eligible) and their own documented policies. While San Antonio once passed a paid sick leave ordinance, it is not currently enforceable. Employers must follow federal laws and their own written policies.

Payroll and time records must be kept for at least three years under the FLSA but best practices for Texas Small Businesses four years. I-9 forms must be retained for three years after hire or one year after termination, whichever is later. Consider retaining certain records longer if you are subject to EEOC, ADA, or ADEA compliance.

Not by state law, but the EEOC strongly recommends it, and courts look at training history in claims. Many San Antonio employers adopt annual training as a best practice to reduce liability. Document all training efforts and make them part of your onboarding and annual compliance reviews.

No. Texas law does not require breaks. If you provide them, FLSA rules apply: breaks under 20 minutes must be paid, while meal breaks over 30 minutes can be unpaid if the employee is fully relieved of duty. While not required, providing breaks can boost productivity and morale; ensure consistent practices across staff.

I-9s must be stored separately from personnel files and accessible within three business days of an audit request. Digital storage is recommended for speed and security. Use a secure, compliant digital I-9 system if possible, and ensure access is restricted to authorized personnel only.

Faulkner HR Solutions brings an outside perspective, spots gaps faster, and designs systems that work without unnecessary bureaucracy. For San Antonio employers, we also understand the local workforce culture and Texas-specific legal environment.

Final Take: Making HR Compliance a Competitive Advantage in San Antonio

Most business leaders in San Antonio see HR compliance as a burden. I see it as your hidden growth strategy. Employees stay longer when systems are clear and fair. Managers lead with confidence when policies are consistent. And when your compliance foundation is strong, you stop fighting fires and start building momentum.

At Faulkner HR Solutions, we help San Antonio small businesses fix broken systems before they cost you talent, time, or trust.

👉 Download our Owner's Playbook for Texas HR Compliance

👉 Schedule a Compliance Audit Consultation

👉 Partner with Faulkner HR Solutions to modernize your HR

Authored by Dr. Thomas Faulkner, SPHR, LSSBB | Founder, Faulkner HR Solutions

Disclaimer: This guide is educational and not legal advice.